In 2026, one of the biggest reasons Americans are not receiving their expected IRS refunds — often around $2000 — is identity verification delays. The IRS has expanded fraud prevention measures, which means more returns are being flagged for review.

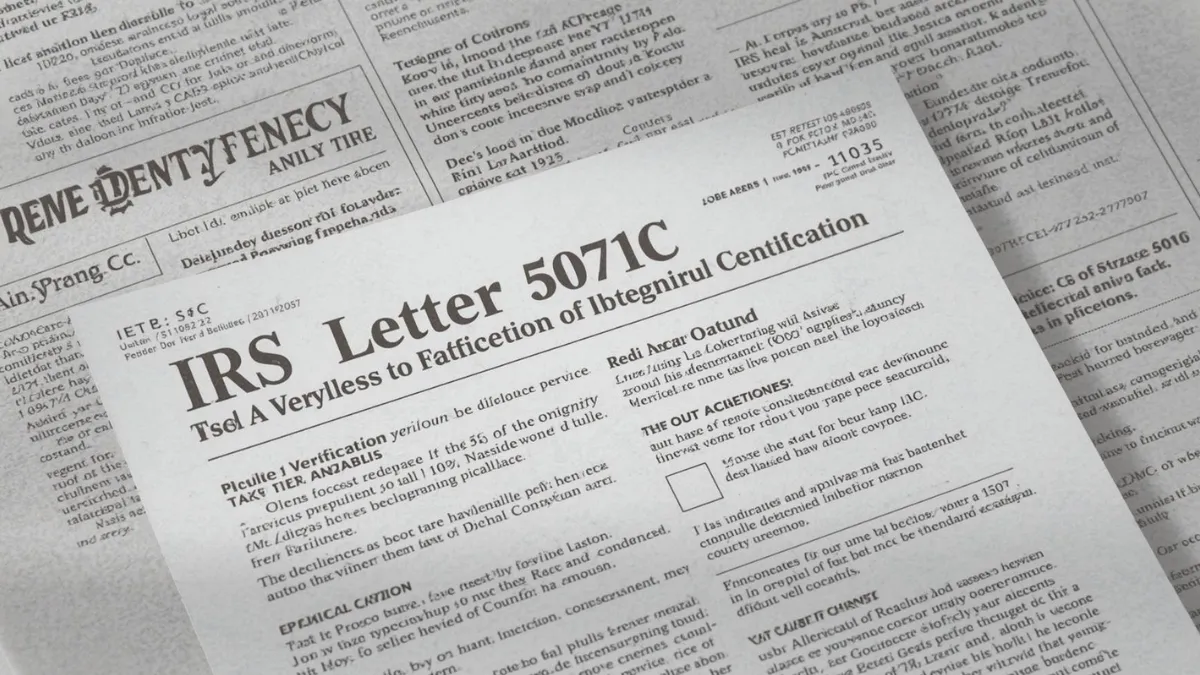

If you received Letter 5071C, 4883C, or a similar notice, your refund is likely frozen until you verify your identity. The good news: this problem is fixable if you act quickly and correctly.

Why IRS Identity Verification Is Triggered in 2026

The IRS uses automated filters to prevent tax fraud. Your return may be flagged even if you did nothing wrong.

Common triggers include:

-

First-time filing from a new address

-

Large refund claims

-

Income mismatch with prior years

-

Suspicious login activity

-

Random fraud screening

Because fraud attempts have increased, the IRS is reviewing more returns than ever.

Signs Your Refund Is Stuck for Identity Verification

You may be affected if:

-

Your refund status says “still being processed” for weeks

-

You received IRS Letter 5071C, 4883C, or 5747C

-

Your IRS online account shows identity verification required

-

Your refund timeline suddenly stopped updating

👉 If you see these signs, your refund will not move until verification is complete.

Step-by-Step Solution to Fix IRS Identity Verification Delay

Step 1 — Read the IRS Letter Carefully

Locate the notice number (5071C, 4883C, or 5747C).

Each letter has slightly different instructions.

✔ Do not ignore the letter

✔ Check the deadline mentioned

✔ Use only the official IRS link provided

Step 2 — Verify Your Identity Online (Fastest Method)

You will typically need:

-

Social Security Number

-

Tax return copy

-

Mobile phone in your name

-

Photo ID (sometimes required)

Best practice: Complete verification within 48 hours of receiving the letter.

Step 3 — Phone Verification (If Online Fails)

Call the number listed on your IRS notice.

Tips to succeed faster:

-

Call early morning

-

Have prior-year tax return ready

-

Keep employer details handy

-

Be patient with hold times

⏱ Phone verification can take longer but works if online fails.

Step 4 — Monitor Your Refund Status

After successful verification:

-

Refund usually resumes processing

-

Status updates within 1–3 weeks

-

Direct deposit follows normal timeline

⚠️ Do NOT file an amended return unless IRS instructs you.

How Long After Verification Will You Get Paid?

| Situation | Typical Time After Verification |

|---|---|

| Simple case | 1–3 weeks |

| Manual review | 3–6 weeks |

| Additional documents requested | 6–9 weeks |

| Paper check issued | +1–2 weeks mailing |

Most taxpayers receive their refund within a few weeks after successful verification.

Mistakes That Can Delay Your Refund Even More

Avoid these common errors:

-

Ignoring IRS letters

-

Entering wrong verification info

-

Filing a second tax return

-

Amending return too early

-

Calling IRS repeatedly without need

These mistakes can reset your processing clock.

Pro Tips to Avoid Identity Verification Next Year

Smart taxpayers can reduce risk by:

-

Filing early in the season

-

Keeping address consistent

-

Using the same bank account

-

Creating an IRS online account in advance

-

Protecting your SSN from leaks

While not guaranteed, these steps lower your chances of being flagged.

Conclusion

IRS identity verification delays are one of the biggest refund blockers in 2026 — but they are usually temporary. The key is to respond quickly, follow the exact instructions in your letter, and avoid panic actions like filing duplicate returns.

For most taxpayers, once verification is complete, the refund — even one near $2000 — begins moving again within weeks.

Staying informed and acting fast is the smartest way to unlock your IRS payment.