In 2026, millions of Americans are searching for answers about the widely discussed $2000 IRS payment. While no nationwide stimulus has been officially approved, many taxpayers expecting refunds around this amount are facing delays, status freezes, and IRS processing issues.

The good news: most of these problems have clear solutions. Understanding what’s causing the delay can help you fix the issue faster and avoid costly mistakes.

Why IRS Payment Problems Are Rising in 2026

As the IRS handles a heavy volume of returns, several factors are creating bottlenecks.

Key reasons taxpayers are facing issues:

-

High filing volume in early 2026

-

Increased fraud prevention checks

-

Identity verification requirements

-

Bank deposit errors

-

Credit-related review delays

The IRS has tightened security filters, which means more refunds are being manually reviewed than in previous years.

Most Common IRS $2000 Payment Problems

H3: Refund Status Stuck on “Processing”

What’s happening:

Your return is under review or waiting in the IRS queue.

Quick Fix:

-

Wait at least 21 days after e-file

-

Check Where’s My Refund tool daily

-

Avoid filing a duplicate return

-

Watch for IRS notices in your mail

👉 Most processing delays resolve automatically.

Identity Verification Required

What’s happening:

The IRS flagged your return for identity confirmation.

Quick Fix:

-

Look for IRS Letter 5071C or similar

-

Complete verification online immediately

-

Keep tax documents ready

-

Monitor refund status after verification

⚠️ Your refund will NOT move until this step is completed.

Direct Deposit Failed

What’s happening:

Your bank rejected the IRS deposit.

Quick Fix:

-

IRS will automatically mail a paper check

-

Confirm your mailing address is correct

-

Update banking info on next year’s return

-

Do not attempt mid-process changes

⏱ Paper checks typically take several extra weeks.

Refund Amount Different Than Expected

What’s happening:

The IRS adjusted your return.

Quick Fix:

-

Read the IRS adjustment notice carefully

-

Compare with your filed return

-

File Form 1040-X only if IRS made an error

-

Do nothing if adjustment is correct

IRS Refund Timeline — What to Expect in 2026

Filing Method Typical Time When to Worry E-file + Direct Deposit 7–21 days After 21 days Paper Return 6–10 weeks After 10 weeks Identity Verification Case 3–9 weeks After 9 weeks Review/Audit Hold Several weeks If IRS requests ignored Understanding the correct timeline prevents unnecessary panic.

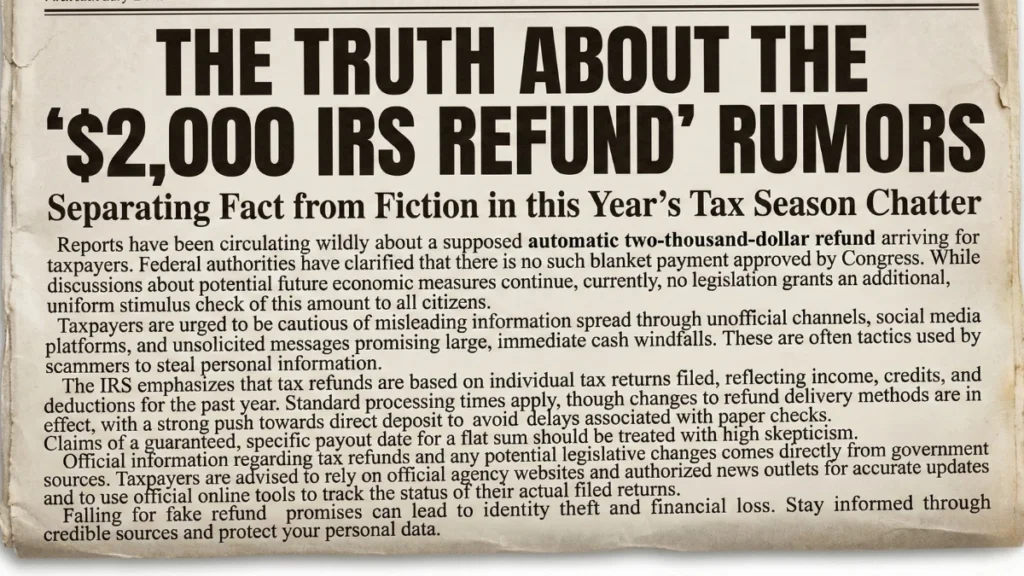

Warning Signs of $2000 IRS Payment Scams

With the viral buzz around $2000 payments, scams have surged.

Red flags to watch:

-

Text messages promising instant IRS money

-

Emails asking for personal details

-

Social media posts saying “claim now”

-

Links that are not IRS.gov

✔ The IRS does not initiate contact by text or social media.

What Taxpayers Should Do Right Now

If you’re waiting for a refund near $2000 in 2026:

-

Check refund tracker first

-

Read every IRS letter carefully

-

Complete identity verification fast

-

Avoid refund myths on social media

-

Be patient with normal processing windows

Taking the right steps early can prevent months of delay.

Conclusion

The buzz around the IRS $2000 payment has created confusion across the United States. While no new stimulus has been confirmed, refund-related delays are very real in 2026.

The key is understanding the exact problem and responding quickly. In most cases, the money is still coming — it just requires the right action and a bit of patience.

As IRS enforcement and fraud checks increase, taxpayers who stay informed will receive their refunds the fastest.

-